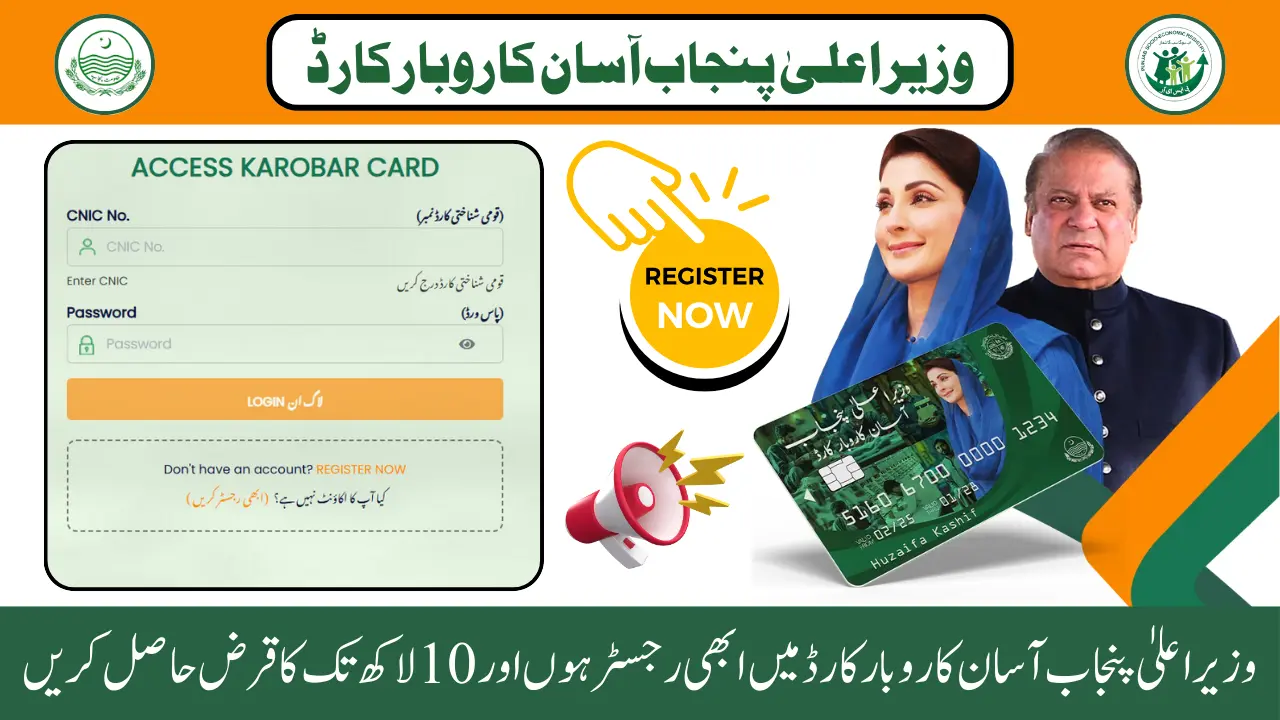

CM Punjab Asaan Karobar Card

CM Punjab Asaan Karobar Card has been launched by Punjab Chief Minister Maryam Nawaz Sharif to promote Karobar activities in the province of Punjab, through which an interest-free loan of up to Rs 1 million is being provided.

This loan has been introduced by the Punjab government to promote small-scale Karobares in the province of Punjab, and the Punjab government will ensure that this loan is used only for Karobar purposes. If you also want to get this loan from the Punjab Government, then today in this article we will inform you about the complete procedure on how you can get this loan from the Punjab Government, what eligibility criteria you have to meet, and what additional charges you have to pay on this loan. So, read the article completely.

Verify Your PSER Survey Status & Eligibility for Punjab Benefits in 2024

Key Features of CM Punjab Asaan Karobar Card

The loan period provided is three years, while the grace period of the loan starts three months after the card is issued. You can use this loan for vendor and supplier payments, and can also be used for your utility bills, government fees, and taxes. A limit of up to 25% has been set by the Punjab government for cash withdrawal for miscellaneous Karobar purposes.

It can also be used for digital payments through POS and mobile apps. The repayment period will be in the form of 24 monthly installments after the first year, and you will have to repay this loan to the Punjab government. In this loan, you have been given the facility that you can use your loan repeatedly for the first 12 months, i.e. one year. You are being told about the end-user interest rate that no interest will be charged on it.

Eligible Criteria Set by the Government of Punjab

You are being told about the eligibility criteria for the CM Punjab Asaan Karobar Card. For this, the following conditions must be met:

- You are a citizen of Pakistan.

- You should have a National Identity Card (CNIC) issued by the Government of Pakistan.

- You are a permanent resident of the Punjab province.

- You should have a valid mobile number registered in your name.

- Your age should be between 21 and 57 years.

- You are a Small Entrepreneur (SEs) in Punjab province.

- Your Karobar is located somewhere in the Punjab province.

- Only one application can be submitted per Karobar.

- Your credit history should be minimal, i.e. you should not have availed any loan from any other institution.

PSER Online Registration 2025 Final Deadline Apply Before 15 Feb

CM Punjab Asaan Karobar Card Registration Process

If you meet all the eligibility criteria, then you are being told how you can get yourself registered in CM Punjab Asaan Karobar Card. For registration, the Punjab government has introduced a portal of “akc punjab gov pk”, where you have to enter your information after creating your account so that you can successfully register in CM Punjab Asaan Karobar Card.

Account Creation Process

- Go to the “akc punjab gov pk” portal.

- First of all, create an account to submit your application.

- Click on the Sign-Up button and fill out a form, which includes the Name, Father’s Name, CNIC Number, Date of Birth, CNIC Issue Date, CNIC, Expiration Date, Mobile Number, and Password.

- After registering an account, log in using CNIC and password and complete the application process.

Application Steps:

Step 1: Provide personal details, which include:

Current Address, Gender, Division, Tehsil, District, Province, City, Ownership of Residence, Number of Dependents, Educational Qualification, Experience, Employment Status, etc.

How to Register on the PSER Web Portal for Nigehban Rashan Program 2025

Step 2: Add Karobar Details:

Nature of Karobar, Karobar Name, Percentage of Participation, Date of Establishment of Karobar, Karobar Address, National Tax Number, Registration Authority (if the Karobar is registered), Monthly Sales, Income, Expenses, etc.

Step 3: Provide Loan Related Information:

Loan Amount Required, Purpose of Loan, Type of Collateral, Nature of Facility, etc.

4th and final step: Upload required documents:

- Photograph of the front and back sides of the identity card.

- Account statement (if required, not mandatory)

After applying, if all your documents are found to be correct, clear, and complete, the Punjab government will announce the selected candidates. If your name is included in the selected candidates, you will be provided with an interest-free loan of up to Rs 1 million, with which you will be able to start your Karobar.

CM Punjab Laptop Scheme 2025 Timeline, Details About Laptops, Eligibility and Registration Process

Loan Charges and Features of CM Punjab Asaan Karobar Card

When you register for CM Punjab Asaan Karobar Card, you will have to pay the following charges:

Processing fee:

- You will have to deposit Rs 500 as a non-refundable processing fee to the Punjab government.

Annual card fee:

- You will have to pay Rs 25,000 as an annual card fee + Federal Excise Duty (FED).

Additional charges:

- Life insurance, delivery charges, and other banking services charges will also be applicable.

- Late Fee Charges:

- If you do not deposit any of your installments on time, you will have to pay late charges as per the policy of the respective bank.

Important Condition:

It is mandatory to register with FBR or Punjab Revenue Authority (PRA) within six months of getting your card.

2 Easy Method to Register in Punjab PSER Survey Before Deadlines to Get Free Rashan

Loan Utilization and Repayment Details of CM Punjab Asaan Karobar Card

Loan Utilization:

- You can utilize 50% of the loan in the first six months.

- The grace period of the loan (the time before the installments start) is three months.

- Once you get your card, the loan repayment will start in monthly installments after three months.

Repayment Procedure:

- You will also have to pay an additional 5% grace period installment along with your current installment.

- You will have to submit regular installments to the Punjab Government to repay the remaining 50% of the loan.

- In the meantime, you will also need to register with the FBR and the Punjab Revenue Authority (PRA).

PSER Survey 2025 Registration Deadline Announced Apply Now Complete Guidance

Frequently Ask Questions (FAQs)

What is the CM Punjab Asaan Karobar Card?

It is a government initiative providing interest-free loans of up to Rs 10 lakh to small Karobar owners in Punjab.

Who is eligible to apply for the CM Punjab Asaan Karobar Card loan?

Pakistani citizens aged 21-57, residing in Punjab, with a valid CNIC, mobile number, and a small Karobar in the province.

How can I apply for the CM Punjab Asaan Karobar Card?

You can apply online through the CM Punjab Asaan Karobar Card portal by submitting your personal, Karobar, and loan details.

What is the loan repayment period?

The loan must be repaid in 24 monthly installments after the first year, with a total duration of three years.

Are there any processing fees for the loan?

Yes, a non-refundable processing fee of Rs. 500 and an annual card fee of Rs 25,000 (including FED) must be paid.

Can I withdraw cash from the loan?

Yes, up to 25% of the loan amount can be withdrawn for Karobar-related expenses.

Can the loan be used for other payments?

Yes, it can be used for vendor and supplier payments, utility bills, government taxes, and digital transactions.

Is there any grace period before repayment starts?

Yes, a three-month grace period is provided before the monthly installments begin.

What happens if I miss an installment?

Late payments will incur additional charges as per the bank’s policy.

Do I need to register with FBR or PRA?

Yes, it is mandatory to register with FBR or Punjab Revenue Authority (PRA) within six months of receiving the card.

Maryam Nawaz Negahban Program Started To Provided Free Rashan In Ramzan

Summary

An interest-free loan of up to Rs 1 million is being provided by Punjab Chief Minister Maryam Nawaz Sharif for the promotion of small Karobares, to increase Karobar activities in the province of Punjab. This loan will be given through the “CM Punjab Asaan Karobar Card”. To avail of the loan, the CM Punjab Asaan Karobar Card portal (akc punjab gov pk), where the applicant will have to provide his personal information, Karobar details, loan-related information, and necessary documents.

The loan will be for three years, wherein in the first year, the customer will be given the facility to reuse the loan amount, while in the remaining 24 months, the loan will have to be repaid in monthly installments. No interest will be charged on this loan, and the amount can also be used for utility bills, government office taxes, and other legal payments.

Ramzan Rashan Program 2025 Registration Step by Step Guide – Get Free Rashan

A non-refundable processing fee of Rs 500 will have to be paid for applying, while the annual card fee will be Rs 25,000 which includes Federal Excise Duty (FED). Additionally, additional charges will include life insurance, card delivery fees, and other related expenses. If the applicant is unable to pay any installment on time, he will have to pay late charges as per the bank policy. This scheme is a golden opportunity for those individuals who want to start their own Karobar in Punjab and are looking for financial assistance.